Support huawei to challenge samsung, trillion giant TSMC into how?

The biggest "contractor"

With huawei on the "entity control" list, Google, Intel, qualcomm, and even IEEE,

The flood of history swept through, always someone can stand, finally become a hero.

The biggest "contractor"

With huawei on the "entity control" list, Google, Intel, qualcomm, and even IEEE, which prides itself on fairness, have all chosen to isolate huawei.

One company has come out in support of huawei.

The company is called TSMC, and it's a Taiwanese company. It's a contract wafer manufacturer.

Many people may not have known its name before.

After that, those three words will definitely be remembered by millions of people.

The us ban allowed huawei's hsi and hongmeng to take the stage.

But even with huawei's preparation, there is one part of the supply chain that has struggled to find a solution anytime soon: TSMC's wafer foundry business.

Foundries are simply the builders of chips, while chip design firms such as hsi, qualcomm and nvidia are the designers of the drawings.

Typically, designers don't do it themselves, so they hire construction workers to do it.

TSMC is the industry's biggest contractor, bigger than Intel and samsung.

As the biggest player in the semiconductor industry today, it has a market value of $170.3 billion, or more than one trillion yuan.

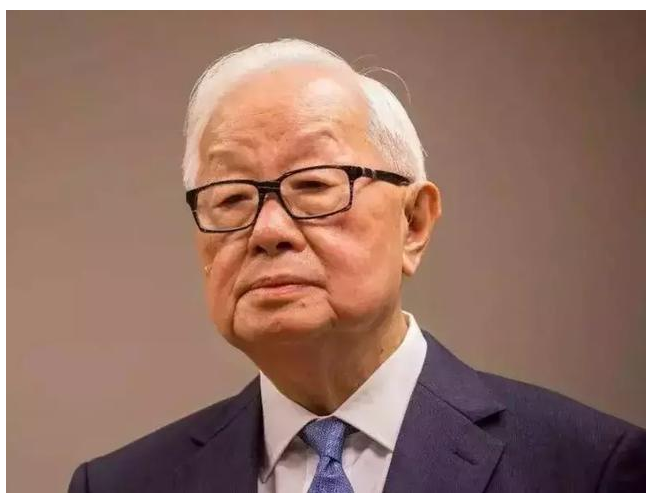

How did trillion giant Taiwan semiconductor manufacturing company become? Maybe it all started with a man.

rule-breakers

In 1987, TSMC was founded in Taiwan, China. At that time, zhang zhongmou was 55 years old. He did not have an advantage in his age when he started his business for the first time.

But perhaps it was the maturity and accumulation that allowed TSMC to emerge unscathed from its many tribulations and grow into the towering tree it is today.

Prior to 1987, most companies in the semiconductor industry adopted the IDM mode. It was very difficult for a company to complete the whole industrial chain from design, wafer manufacturing to packaging and testing, and the investment cost was very high.

But after 1987, the malpractice was overturned by chang.

From the very beginning, TSMC was positioned to do only wafer foundry business, and did not consider other aspects at all.

This not only allows design companies to avoid the worry of stolen trade secrets production costs, but also allows themselves to save the research and development costs of chip design, greatly reducing the entry threshold of the chip industry.

This model is a win-win situation, but its development is not plain sailing.

From the beginning, the semiconductor industry began to decline, and the global semiconductor market declined rapidly.

At the time, TSMC was struggling to survive with small orders. Even in such adversity, Mr Chang managed to create a momentum for TSMC to take off.

In 1988, through personal connections, chang invited Andy grove, the CEO of his old friend Intel and the author of "only the paranoid survive," to Taiwan to study TSMC.

After a rigorous review, TSMC managed to win Intel's certification after fixing more than 200 of the problems it had singled out.

In the absence of industry standards, Intel's certification was significant and the best endorsement of TSMC's manufacturing capabilities.

Later, zhang zhongmou showed his strong style. After implementing the production policy, he insisted on high standards, strictly required the company's employees, and established international standard rules and regulations.

In the years that followed, TSMC's development began to go more smoothly. Coupled with a revival in the semiconductor industry, Mr Chang seized the opportunity to lead TSMC to a successful listing on the Taiwan stock exchange and quickly ramped up production, after which TSMC began its brutal growth.

In 1997, TSMC successfully landed on the New York stock exchange, generating $1.3 billion in revenue and a huge profit of $535 million that year, making it the most profitable company in Taiwan.

TSMC was founded just a decade ago. Over the next 20 years, TSMC began to run.

How did TSMC make it?

The fact that TSMC has grown so fast is inseparable from its three battles.

In the first battle, zhang zhongmou faced his brother zhang rujing. Founded in 1997 by Richard chang, also from Texas instruments, it grew so fast that it became Taiwan's third-largest semiconductor company in just three years.

In time, the world may become a second TSMC. To prevent that, Mr Chang persuaded worldbank's first shareholder to buy the company without informing Mr Chang.

Aggrieved, Mr Chang went to Shanghai to set up smic, which spent a lot of money poaching people from TSMC, and got TSMC's trade secrets.

In the face of smic's attack, TSMC used legal means to file a lawsuit against smic, which won 375m us dollars in compensation and forced Mr Chang to leave his job.

In the second world war, TSMC faced Mr Grophand. When grofonde was founded in 2009, TSMC employees felt unprecedented pressure due to the power and advanced technology behind it. Facing such a powerful enterprise, everyone had to tremble.

But no one expected the battle to end so quickly, and the furious grofonde was defeated in an instant.

A key technology choice for the 28nm process is the gate first and gate second. As the most advanced manufacturing process at that time, whoever can successfully mass production first will undoubtedly build up a great advantage. In the case that samsung and grophonde both chose the first gate, Mr Chang defied public opinion and resolutely adopted the second gate.

As a result, samsung and groford have been slow to improve their yield, while TSMC has been successful in mass production. TSMC's victory not only puts it in the leading position in manufacturing technology, but also gives it ultra-high pricing power, which benefits it enormously.

In the third battle, TSMC faces samsung. Samsung has long been TSMC's biggest rival among the eight global contract manufacturers, competing with TSMC for years for the right to speak about new manufacturing processes.

To that end, samsung and TSMC, which account for 70 per cent of global foundries and 50 per cent of TSMC's capital expenditure, have started a process race.

And both companies continue to increase capital, the final result is that today's samsung and TSMC are both monopolistic giants in the foundry industry.

And TSMC has always had an advantage in the battle with samsung, and is far ahead in terms of market share.

For now, at least, samsung is losing out to TSMC in wafer manufacturing.

summary

TSMC has put itself on the throne in three campaigns and emerged as the biggest winner in this smokeless war.

But its rivals have not given up. Mr Grophand, samsung and Intel still wield considerable influence.

The battle of wafer foundry may just be beginning.

In 2009, when TSMC was facing a loss crisis, chang returned to the CEO position and pulled back the tide.

In 2018, at the age of 87, he announced his retirement from the semiconductor industry.

TSMC, still in the midst of a torrent, has not been weakened by his departure.

Because chang has already taught countless TSMC people how to do it and showed them the way.

(disclaimer: this article is transferred from the network, the copyright belongs to the original author, if necessary, please contact us to delete)